Since 2019, global battery electric vehicle (BEV) sales have surged from 1.6 million to 9.6 million cars in 2023, capturing around 15% of the global market, according to clean transport group T&E. Carmakers have significantly increased their investments in EVs and batteries, driven by stringent global regulations, including the EU’s car CO2 standards.

T&E has examined EV, battery, and charging investment announcements by 19 global carmakers between 2021 and 2023, highlighting the regional and corporate leaders in EV investments.

Global investment announcements in EVs, battery cells, and charging infrastructure by the analyzed carmakers have increased nearly sixfold from 2021 to 2023, reaching €150 billion in 2023 alone. In total, €265 billion in investments were announced during this period, nearly equating to the annual GDP of Romania, underscoring the strong demand for EV investments.

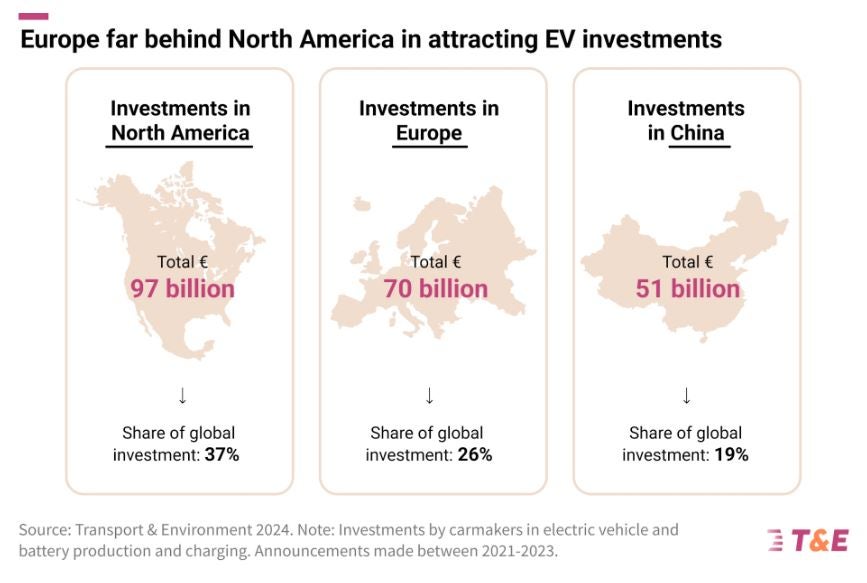

European carmakers led the pack, accounting for the largest share of investment announcements at 34%, followed by Chinese (20%) and South Korean (18%) carmakers. Despite this leadership, North America emerged as the primary destination for these investments, attracting 37% of the announced funds compared to Europe’s 26%. North America’s allure is largely due to generous local manufacturing subsidies under the 2022 U.S. Inflation Reduction Act, which incentivized European, Japanese, and South Korean carmakers to invest in the region.

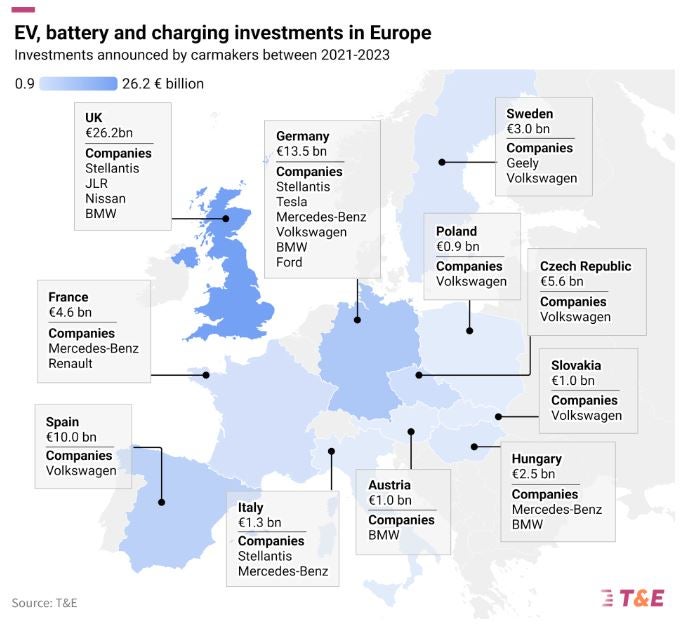

In contrast, Europe has struggled to attract foreign EV investments. While European carmakers contributed the majority of investments within the region, non-European carmakers, including Tesla Geely, Nissan, and Ford, made up only 20% of the investments. Among European carmakers, only BMW, JLR, Renault, Mercedes, Nissan, and VW directed more than 50% of their investments to Europe. Major European carmaker Stellantis allocated just 10% of its announced investments to Europe, focusing 74% in North America. This trend signals potential issues for Europe’s competitiveness in the EV sector without a coherent industrial strategy to rival China and the U.S.

Within Europe, investments were concentrated in 10 EU Member States and the UK, with the UK, Germany, and Spain securing 71% of the announced investments. The UK, driven by substantial investments from JLR, received the largest share. In Germany, Tesla was the leading investor with €4.5 billion, followed by VW (€3.1 billion), and Ford (€2.7 billion). Spain attracted significant investments from VW, amounting to €10 billion. Italy, a key manufacturing hub for Stellantis, attracted a modest €1.3 billion, which now faces delays.

Despite leading in total EV investments between 2021 and 2023, growth in European carmakers’ investments is slowing. After announcing €29 billion in investments in 2022, the increase was just €4 billion in 2023. This slowdown is likely due to the absence of tighter CO2 standards beyond 2025 until 2030, reducing the immediate need for further investment growth in Europe. Additionally, when normalized based on sales, European carmakers are investing less than their U.S. counterparts, with €3,840 per car sold compared to €4,970 by U.S. carmakers.

This trend raises concerns about the future leadership of the European automotive industry in the EV market. With 80% of European EV investments coming from domestic carmakers and recent announcements of delays in EV investments or targets by companies like Mercedes, VW, and JLR, Europe’s position in the global EV race may be at risk.

FAQ Section

Q: How much have global battery electric vehicle sales increased since 2019?

A: Global BEV sales have surged from 1.6 million to 9.6 million cars in 2023.

Conclusion

The surge in global battery electric vehicle sales and investments in EVs and batteries by carmakers indicate a significant shift towards sustainable transportation. However, regional disparities in investment distribution and the slowdown in European carmakers’ investments raise concerns about Europe’s competitiveness in the EV market. Coordinated efforts and strategic industrial policies may be necessary to ensure Europe maintains its position in the global EV race.